Build, Buy, Partner Analysis

All innovation requires capital. For large corporations not used to innovating, finding, defending and scaling this capital is extremely difficult. This article explores how the allocation of resources and the organization of innovation financing can support a large company’s innovation. With a new budgeting framework and finance practices you can position your existing business and new idea for innovation success.

In this training, you will

- Read a survey of existing literature that frames how finance departments can account for investments in innovation.

Skills that will be explored

Balancing Finance and Innovation

“We’re in a period of incredible change in how you fund innovation, especially entrepreneurial innovation”

— Ethan Mollick, Professor of Management Science at the Wharton School, 2012

Finance and innovation have a tempestuous relationship, partly because one espouses discipline and rules and the other wants to transcend norms and boundaries. And, within this contentious union, the finance department is the gatekeeper of a modern company’s strategic direction – or at least its pecuniary resources.

Irrespective of whether an idea offers future market dominance conceptually, the immediate decision to pursue it is almost always made with the following financial question in mind: “How will this affect next quarter’s earnings?”

This is a nearsighted perspective, necessary when keeping to budgets but not conducive to long-term innovation activities. The perspective is a result of governance. CEOs are often pressured to please the shareholders in the short term rather than dig in and plan for a more secure and successful future.

In the finance department, CFOs struggle to commit to long-term innovation funding in this governance context as they study quarterly balance sheets and feel the heat. Compounding the limitations are antiquated legacy tools that have been in use for years to assess ongoing projects with ill-fitting metrics; the finance department has been a back-office function, but it needs to be brought into the modern digital age.

For a company to improve, change, and innovate over time, the finance department needs to be along for the ride. And since the finance department controls the resources necessary for innovation success, a formula that quantifies innovation efforts in a way that keeps both the visionaries and the shareholders happy could be the answer. Is it possible, then, for the risk-averse finance contingent to support the risk-oriented innovation pioneers?

Innovation – Who Does It and Who Pays for It?

When looking at operational spending, it’s easy to focus on cost-cutting and efficiency. After all, efficiency is what boosts the bottom line. It’s also a guarantee that if a cheaper raw material can be used or supply chain kinks can be ironed out, cost savings will boost earnings to the delight of analysts and investors.

But what’s not so easy is allocating resources to future improvements and innovations that have no tangibility or guarantee whatsoever. Planning for the future is always a thought, but how does it translate to the operating budget?

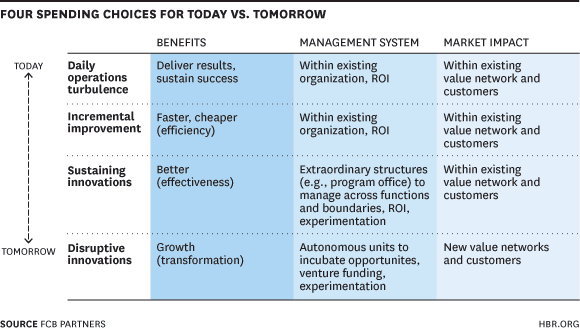

Brad Power, a management consultant in process innovation, and Steve Stanton, co-founder of FCB Partners, created a framework showing choices leaders have when it comes to allocating resources for innovation (Figure 1).

Source: FCB Partners via Harvard Business Review , 2014

Power and Stanton illustrate that disruptive innovation takes autonomous units, incubators, and venture funding for experimentation. Innovation for the future requires collaboration from many directions. For example, public relations need to be addressed in the age of digital communications and mobile culture; HR management requires a whole new approach that focuses on the employee experience. Resources, then, must be allocated for the pursuit of new value networks, partners, and customers.

Power and Stanton also polled managers from various industries to find out how they were currently allocating resources for innovation. They found that most managers wanted to spend less on day-to-day operations and double the amount spent on big, disruptive innovations.

Leaders are clear that there is a need to invest in the future, but they are unclear as to where exactly to deposit those innovation funds. Who exactly is doing the innovating? Which department is responsible for the expenses?

Innovation Spending on R&D

There is a belief among some in the C-Suite that R&D is responsible for innovation. But the relationship is more complicated. Recent data show that the connection between R&D spending and innovation, or lack thereof, has no statistical relationship with common growth metrics.

The 2016 “Global Innovation 1000” study by PwC Strategy shows that the ten most innovative companies outperformed the top ten R&D spenders, which refutes traditional theory and past research studies. The study points to the rise of economic nationalism, an inward-looking, domestic, and isolationist approach to growth, as a movement that has thrown the world of innovation into uncertainty.

To illustrate, data from Stratey& and PWC shows that Apple and Alphabet continue to lead the most innovative list, followed by 3M and Tesla; however, the companies that spent the most on R&D were Volkswagen, Samson Electronics, and Amazon. Apple spent $8.1 billion on R&D, outperforming Volkswagen in innovation, which spent a colossal $13.2 billion. 3M spent just $1.8 billion on R&D and outperformed Samsung, which spent close to $13 billion.

While it is true that many Fortune 500 companies have found success while funding robust R&D programs to compete in industries dominated by physical products, conducting great R&D and achieving market success with inventions and technologies are two different things.

Artificial intelligence, for example, was invented back in 1992 when Yann Lecun, a computer scientist, built a computer chip called ANNA, a play on the term “artificial neural network.” But it wasn’t until recently that the technology was developed further, using deep neural networks to perform tasks that can be applied in today’s digital environment, such as facial recognition or language translation.

Thus, an invention is all well and good. To be profitable, however, it must have two additional components – customer value and a business model – and all three components need investment and management. We go deeper into this relationship in our guide on research and development.

“Innovation = invention + customer value + a business model.”

— Tendayi Viki, Managing Partner at Benneli Jacobs, 2016

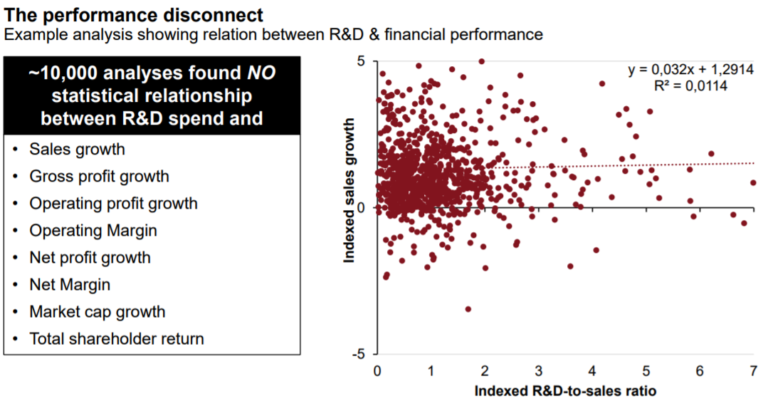

Figure 2: R&D Spending Versus Financial Performance

Source: PwC , 2016

Figure 2, taken from Strategy& and PWC’s 2016 Global Innovation 1000, when loosely interpreted, shows that companies that invested more in R&D did not necessarily see better sales growth. If the traditional pairing of R&D investment and innovation is no longer a path to guaranteed innovation, what is?

A Separate Innovation Budget and New Partnerships

“One of the biggest problems with not having an obvious innovation head is the use of funds for innovation projects can be a little disorganized. ”

–— Michael Fitzgerald, Senior Analyst, Celent

Clay Christensen, professor at Harvard Business School, Author of “The Innovator’s Dilemma,” discusses disruption in the finance sector in an interview with Aria Lewis of Barclays Bank. The world-renowned innovative thinker explains disruption and, in some cases, how its effect is to slow growth in the short term. Christensen specifically explains how accounting cannot account for this slow growth because the discipline uses traditional metrics – yet this slowing is a necessary part of the long-term innovation process.

In many organizations, there is no clear or single department that “owns” innovation. This lack of ownership has led some companies to create a separate budget solely to fund innovation over the long term and, in some cases, to avoid pilfering from other business areas. A survey by Celent found that almost 70 percent of innovation program leaders said they allocated funds from the technology budget to cover innovation costs. A 2017 Harvey Nash / KPMG CIO Survey found that only around 30 percent of organizations are fostering innovation by funding innovation separately.

The big companies take innovation seriously and allocate appropriate resources to an independent department to achieve a long-term focus. If innovation is done piecemeal, by taking resources from other business areas, the limitations stifle creativity.

“Go ahead and do the math on your current allocation; you’ll likely find that more than 90% of your resources are devoted to keeping the lights on.”

— Brad Power, management consultant in process innovation, and Steve Stanton, co-founder of FCB Partners

A separate innovation budget protects long-term projects and frees those involved to pursue creative avenues.

According to Power and Stanton, leading IT organizations manage their budgets with three “buckets”: operations, maintenance, and innovation. These firms try to reduce their spending on operations and maintenance from 90 to 60 percent so that the remaining 30 percent can go toward innovation.

Jeremiah Owyang, Founder of Crowd Companies in Silicon Valley, also points to the need for innovation leaders to have a dedicated budget to fund long-term innovation activities rather than having to tie programs with business metrics and ROI.

Startup Partnerships for New Ventures

As industry has transitioned into the digital age, firms are increasingly trying to innovate by creating fast, independent teams to directly address consumer needs. Startups dominate the world of agility and consumer-focused ventures. With agile business models and a customer-oriented approach, startups epitomize the new innovation model of Viki (2016).

Innovation = invention + customer value + a business model.

Moreover, the digital economy has allowed startups to rapidly expand and disrupt incumbents, and successful corporations are interacting with these startups to gain access to talent and ideas, and to gain insights into innovative culture.

Nestlé, for example is committed to working with startups Nestlé is committed to working with startups. Gerardo Mazzeo, global innovation director and CSV manager at Nestlé, told Bryce Wilcock of BQ of the company’s efforts to working with start-ups to bring more products to market. A dedicated budget allows for more “bleeding-edge” initiatives. Which begs the question: have market leaders such as Nestlé benefited from innovation spending and partnership efforts?

In 2016, Nestlé announced a joint venture with R&R, a leading ice cream company based in the United Kingdom. The venture offers products, including those from Nestlé’s European frozen food business, in Europe, the Middle East (excluding Israel), Argentina, Australia, Brazil, the Philippines, and South Africa and chilled dairy business in the Philippines. Nestlé has gained R&R’s competitive manufacturing model and significant presence in retail.

More bleeding-edge projects for Nestlé include a new partnership with Rabobank and RocketSpace for the Terra Food + Agtech Accelerator. The venture will select and coach some of the most innovative and disruptive startups in the food and agricultural industry to create healthier and more sustainable food products.

PayPal is another example of a company forging partnerships and disrupting a major industry. It aced a power play opportunity and a partnership with Apple in July 2017 when PayPal became a payment option in Apple’s services. According to Caitlin Huston, report for MarketWatch, the partnership will give consumers another payment option when transacting with Apple – an example of a “consumer-choice” approach.

Granted, Apple is arguably not a startup, but PayPal has that space covered, too. In 2017, PayPal announced that it had picked five young fintech startups for its incubation program in Chennai, India. While the startups get access to PayPal’s tech infrastructure, network, and team, PayPal gets a footing and exposure in the burgeoning Indian mobile payments market. Practically anything PayPal touches turns to gold, so their model is not a bad one to follow.

The point made here is that innovation should be a business department all its own, with a budget dedicated to resources, building partnerships, and taking risks. As with any opinion, however, there are dissenters.

Adi Gaskell, contributor to Innocentive, suggests that a separate innovation department will be too isolated because the perspectives from individuals throughout an organization are required. She suggests an ambidextrous approach where separate innovation teams work alongside “business-as-usual” teams to maximize opportunities for creative input. Gaskell states that even with a separate innovation department, other flexible and temporary teams will be created for new projects. Her idea, then, is to use the “power center” that already exists in an organization – the group or product that attracts the talent or that delivers profits – as the anchor for innovation activities.

Whatever model a company chooses, there will be struggles. But being aware of the pitfalls of each path is the first step to enabling change and improvement.

internal innovation can support company goals.

Old Metrics Don’t Translate to New Products

“At its core, the Finance 2020 organization will continue to protect the integrity of the enterprise and reduce costs. That will never change. What will change is that Finance 2020 will become the value creation center of tomorrow’s digital business.”

— Accenture, Finance 2020, 2015

As with any other business activity, companies need to track the success of their investments and ROI. When it comes to innovation investments, many companies apply the same financial metrics as they do to their core business investments. One example is the “balanced scorecard” approach developed by Robert S. Kaplan, senior fellow and the Marvin Bower Professor of Leadership Development at Harvard Business School, and David P. Norton, founder and director of the Palladium Group.

The approach begins by identifying what is important for the overall success of the company (ROI, reputation for excellence, growth in market share, etc.) and deriving measurable activities that reflect these goals. The activities are plotted as a spider diagram displaying the relative strengths and weaknesses across these activities.

Typical categories include general management, research and technical staff, financial management, customer satisfaction, outreach activities, communication of services, and self-assessment. The trouble is that these metrics are often narrowly focused on short-term results and aren’t conducive to the long-term fostering of intangible creativity that is so crucial for innovation.

In an empirical study presented at the 2013 MIT Asia Conference in Accounting, researchers examined the impact of accounting conservatism on corporate innovation. The authors concluded that the problems that conservatism creates have an overall stifling effect on creative efforts:

- A combination of asymmetric treatment of non-R&D activities and managerial myopia hinders innovation.

- Managers often cut R&D investment to meet earnings reporting.

- Firms are more likely to miss pre-determined targets because accounting conservatism stymies innovation.

- Fewer patents and patent citations imply less innovation.

- Cash flows are reduced and have shorter horizons.

Not surprisingly, according to the study, these negative effects are more pronounced when CEO compensation is tied to company growth and financial performance, when managers are myopic and focused on short-term profits, when firms operate in innovative industries, and when accrual manipulation (deferring expenses to meet quarterly expectations, for example) is more difficult.

Innovation Accounting – a Saner Approach

Innovation accounting defines and measures the progress of innovation, such as customer retention and usage patterns for new products or business units. Traditional accounting, on the other hand, when applied to innovation, stifles the progress of the product or business unit.

Traditional accounting tends to assume that a product is already established with revenue and accompanying expenses while new products or startups have no revenue and burn resources. Few innovation ventures stand up to scrutiny based on financial ratios or cash-flow analysis.

Eric Ries is an entrepreneur and author of “The Lean Startup.” In a video interview, he discusses his concept of innovation accounting. Ries explains that innovation accounting is designed specifically for startups, although all organizations should apply it to innovation efforts. It quantifies progress and validates learning using new metrics, not traditional ones.

Steve Glaveski, CEO and co-founder of Collective Campus, explains why traditional metrics don’t work when it comes to evaluating innovation. According to Glaveski, companies should ask themselves the following questions before pinning down new types of metrics:

- Does an idea have the potential to disrupt or is it a low-risk, low-reward incremental improvement?

- Are customers overserved or underserved by existing solutions?

- Does the idea solve a problem?

- Can we build it?

- How steep is the competition?

- Has it been done before, and what were the results?

- Can we test it quickly, economically, and effectively using our existing networks and ability to prototype?

Galveski’s point is that posing these questions for each innovation and rating them as far as risk is concerned is far more relevant and purposeful than going with the following statement: “We expect this new innovation to generate 5% of our revenue growth target for the year and if it doesn’t within 6 months we’ll can it.”

Jeremiah Owyang, Founder of Catalyst Companies, finds that the most common metric attached to innovation program success is increased revenue. But ROI, he says, if measured too soon and before an innovation kicks in, is a fallacy.

Digital Transformation in Finance

“Technology is changing so rapidly and arriving so fast, there is a certain motivation to be cautious and take a waitand-see approach. You might think, ‘I’m going to be smart and sit back a little bit and see what happens before I make a decision.’ The problem is that the change is so significant and the new capabilities so advantageous, that if you take a wait-and-see approach, you run the risk of being put at a severe competitive disadvantage.”

— Tony Kilmas, EY Global Finance Performance Improvement Advisory Leader

The finance department is the “gatekeeper” to funding for every organizational department. And in this digitally charged world, companies need to bring their finance and accounting systems into the digital era.

Digital transformation of finance and accounting means that the cloud allows clients and accountants to work from the same files, which saves time and work. Mobile apps can integrate accounting software with retailer points of sale, send contractor quotes, or provide practically any other type of function a business needs. Real-time decisions can be based on data and forecasts from digital solutions. Artificial intelligence makes accounting software smarter – finding trends and identifying the most profitable business areas.

In a white paper, PwC suggests five pillars for integrating digital financing solutions into the front office:

- Collaboration and team communication. Digital tools for real-time communication between virtual teams anywhere in the world are more important that a focus on technical finance skills.

- A digital workforce using software robotics should replace time-consuming manual processes.

- Data and analytics using big data, artificial intelligence, and machine learning provide insight generation.

- Agility from cloud computing and software-as-a-service (SaaS) gives businesses and startups access to tools and enterprise resource planning at far lower costs.

- Cyber security through a digital CFO can proactively address security threats.

Workforce Upskilling – from Microsoft Excel to Hadoop

In addition to a digital workforce composed of software solutions, finance staff need a different skill set, even if SaaS or outsourcing is doing much of the work. Tech-savvy, digitally versed workers are the new in-demand demographic. Data scientists who are proficient in Hadoop, Oracle, and big-data-oriented computer languages such as Scala will become exceedingly hard to find.

At a time when cyber threats are increasing exponentially, the demand for security analysts to thwart them is rocketing. The Bureau of Labor Statistics reports that the percent change in employment or security analysts from 2016 to 2026 is expected to be 28 percent. Compare that to the average change expected for all occupations at 7 percent.

Analysts will be required to parse big data from machine learning tools; employees that understand the SaaS model and the private, public, and hybrid cloud environment will shoulder the responsibility of integrating new systems with existing infrastructure. Firms will need talent to integrate artificial intelligence, virtual reality, the Internet of Things, and new platforms, tools, and languages to advance their automation and DevOps.

But have we jumped ahead of ourselves on the technology front?

A 2017 report by Robert Halfand the Financial Executives Research Foundation collected responses from over 1,400 financial leaders in the United States and Canada to assess the performance and state of accounting and finance functions. The study found that almost 70 percent of U.S. executives surveyed said that they continue to use Microsoft Excel as their primary budgeting and planning tool, which marks an increase from the previous year.

Why are companies clinging to legacy systems and trusted steeds such as Microsoft Excel? Traditional software such as Excel is creating a drag on digital transition; at a time when companies need to be more nimble, clunky infrastructure holds things back.

According to Joe McKenrick, author and independent analyst, the authors of an IFS study jokingly conclude that enterprise resource planning (ERP) really stands for “Excel Runs Production” because of a reluctance among finance departments to stop using spreadsheets. Companies are delaying investing in specialized tools because of the costs associated with implementing them and the difficulties involved in fulfilling individual project and department requirements.

The truth is that it is costlier not to embrace digital. Legacy or outdated systems take more time and impose greater risk. For example, spreadsheets need to be reworked, employees need to learn how to work around Excel constraints, there are more errors (sometimes up to almost 90 percent), broken links, and susceptibility to fraud.

“Corporate analytics teams have reached the extremes of Excel… Excel tasks will be done elsewhere such as in analytics platforms and cloud-based modeling tools.”

— Ian Bennett, FPA, Acuity, 2016

According to Philip Howard, research director at European IT consultancy Bloor Research, Excel is so limiting to organizations that modeling training for the software is less about how to use its advanced features and more about helping analysts cope with its constraints, particularly when finance departments resort to solutions such as ClusterSeven, a cloud-based spreadsheet manager. The problems with ClusterSeven, for example, are that there is no audit capability, no control over changes, and data analysis is unwieldy.

Digital solutions are fast and cost-effective. What’s more, they provide the infrastructure for tomorrow’s technology and prepare financial operations for the next evolution. Not digitally transforming means slowing down financing, budgeting, accounting, and the overall innovativeness of an organization.

New solutions such as Tagetik, Adaptive Insights, and Anaplan are intelligent systems. Rather than hamper creativity, they can supplement or replace Excel, provide real-time reporting and business forecasting, and perform tasks that spawn optimal business decisions based on big data for future innovation.

Companies need to be ready for the next technological movement with the right infrastructure. Blockchain is another disruptor that portends change in every aspect of our future. It has the potential to disrupt global trade, global financing, and global supply chain management, among others. It reinvents the basic building block of commerce. According to David Meyer, contributor to Fortune, the ledger is recording transactions at lightning speed, driving major banks such as Barclays, Canadian Imperial Bank of Commerce, Credit Suisse, HSBC, MUFG, and the Canadian Imperial Bank of Commerce to experiment with blockchain.

Change is just not an option if a company wants to nurture innovation and stay relevant. Combining wisely chosen solutions with a workforce that can optimize them supports innovation efforts. For the more hesitant finance managers, the new platforms are so versatile that even the King of Spreadsheets – Microsoft Excel – can be integrated into new infrastructure.