1. Introduction

You will dive deep into your customer to increase the chances of your business’ success while reducing the risk of your new idea. To make the process as efficient as possible, you will start with existing research. Once you have reached data saturation (which you will learn about), you dive into qualitative research. This will inform your quantitative research. Once you are done synthesizing and summarizing your research, you will pick your customer and move onto the Competitor section of HowDo's Planning process.

In this training, you will

- Develop a deep, accurate and precise understanding of your customer.

- Learn how to use secondary research to generally understand your customer.

- Learn how to use qualitative and quantitative research to precisely understand your customer.

- Learn who the customer thinks your competitors are

- Learn how to choose your customer

Skills that will be explored

1.1 What Is Your Hypothesis / What Are You Trying to Learn?

Understanding the ‘customer’ using the process of Entrepreneurial Innovation is a 3-step process:

- Learning about the customer problem to come up with an idea;

- Speaking to additional customers to see if the idea solves the problem;

- Engage in MVP testing to reiterate customer feedback.

1.1.1 Learning about your customer problems to come up with an idea.

Most successful founders treat themselves as the first customer and solve their own problem. Take Airbnb: The year was 2007, and roommates Joe Gebbia and Brian Chesky couldn’t afford their San Francisco rent. The pair knew a big design conference was coming to San Francisco, and it was making hotels hard to come by. And so it all started with an email: Gebbia wrote Chesky with an idea: What if they turned their loft into a designer’s bed and breakfast, complete with a sleeping mat and breakfast? It was a way to “make a few bucks.” The duo, who had met at college at the Rhode Island School of Design, thought acting as tour guides to designers would be a fun way to make money. 12 years later, that idea is worth $31 billion.

1.1.2 Speaking to additional customers to see if your idea solves their problem.

Seeking customer feedback is an important process of being customer centric; the Uber case study is the perfect illustration of this. When Uber was first validating its idea (back when it was UberCab), Travis Kalanick, Uber’s Founder, was in charge of the Supply side. He cold-called 10 existing black-cab drivers and shared the concept of Uber. Three hung up, a few listened and three wanted to meet. The fact that 30% wanted to meet gave Travis the confidence that there was demand for his idea. The test is: Does the idea solve a problem the customer is experiencing?

1.1.3. Engage in MVP testing and reiterate on customer feedback.

MVP testing is an integral part of scaling a startup and the Slack case study is the perfect example of the importance of reiterating on customer feedback. When Slack first launched, they launched with around 10 companies and they begged and cajoled their friends at other companies to try it out and give them feedback. The Slack team was determined to seek answers and feedback from customers who already tried the product.

All three examples demonstrate important customer discovery is to validate the venture fixes a customer problem. However, it is equally important to also understand what part of the customer discovery phase the venture is in.

The best tactic to ensure you ask customers the right questions is by being clear on the hypothesis you are trying to prove/disprove. The following section demonstrates how important customer obsession is in the MVP discovery, design, development and testing process. You can also find more of this, in depth, in HowDo’s Product module.

2. Why Customer Obsession Is Critical to Success

2.1 Why Spending Time Identifying Your Customer Helps You Build the Right Solution

Thought Exercise: Finding a customer for an idea

As an entrepreneur, understanding your customer is of the utmost importance. Take a moment now to visualize your idea and jot down who you think would be your customer.

Now that you have identified a customer for your idea idea you have, stress-test your assumptions on who is your customer. This will help you gain a greater understanding of the customer as It is critical that you deeply understand their needs and pains.

Case study: #2 Pencil

Now, a simple explanation of the importance of new ventures being customer centric is the #2 Pencil. In this case, we’ll look at a #2 pencil as a solution. Other possible examples might be Chromebook for education vs. Mac for professional/creative or Salesforce for enterprise vs. Hubspot for SMB.

A #2 pencil solves a perfect need for one customer: a high school teacher whose students are taking a multiple choice test. The pencil provides a solution that allows their students to mark multiple choice answers and erase them as needed. This solves the problem of excessive scribbles and illegible answers from students, which could be an issue if they chose to use ink pens.

The #2 pencil is also a great solution for a range of other customers:

- Accountants during tax time who write a lot and must easily erase mistakes;

- Writers who are constantly editing and revising their work;

- Golfers who need to keep score on the course during a round;

- Carpenters who need to draft markings on walls and other materials;

- Artists who are crafting vibrant, colorful masterpieces.

Now, although the original yellow wood, medium darkness, medium softness #2 pencil is the perfect solution for the teacher/student scenario, it may not be for other user cases.

Golfers, for example, have no easy way to carry around a standard length 7.5” #2 pencil while on the golf course. Instead, golf courses provide a smaller solution, short pencils, that uniquely solves golfers’ problem of needing a portable writing utensil.

Similarly, carpenters also have unique needs because they are not just writing on paper. They might be writing on wood one day and stone the next. A larger size pencil with a higher grade of lead density helps carpenters ensure their markings are visible on any surface and are easy to trace.

Lastly, artists need color and require a variety of different stroke sizes and shades. For an artist, a #2 pencil alone might create one style of a masterpiece but it won’t meet all of their needs.

The point of the example is that a pencil (i.e. the solution) needs to transform into the right solution for the right customer (teachers, golfers, carpenters, etc.). This requires a deep understanding into the problem of the right customer and the primary use case. The fundamental truth is that an entrepreneur must first start their venture with a strong understanding of the customer and the customer’s problems, before prescribing a solution.

In summary, every type of customer has unique needs and you must solve for those. If you only create one solution and try to sell it to everyone under the sun, you would not likely solve any one problem extremely well.

2.2 Examples of Customer Obsession

2.2.1 Amazon’s Customer Obsession

In 1997, Bezos penned a letter to shareholders stating Amazon would be customer driven rather than shareholder driven. This letter redefined how future startups would be formed, making it an essential read for any modern innovator and entrepreneur.

Ultimately, Bezos made it clear in the letter that meeting quarterly earnings calls and pleasing Wall Street analysts did not fit his idea of building value over the long term. He believed long-term value was about pleasing the customer and that ‘customer-centricity’ was key to long-term profits.

The following are some snippets from the Shareholder Letter along with a loose interpretation of Bezos’ real meaning:

“We first measure ourselves in terms of the metrics most indicative of our market leadership: customer and revenue growth, the degree to which our customers continue to purchase from us on a repeat basis, and the strength of our brand.”

Interpreted:, “The customer, not you (shareholder), is what’s important.”

“We believe that a fundamental measure of our success will be the shareholder value we create over the long term.”

Interpreted: “We will not prioritize quarterly earnings or Wall Street’s reactions to them.”

“Because of our emphasis on the long term, we may make decisions and weigh tradeoffs differently than some companies.”

Interpreted: “You (shareholder) may not like or understand what we decide to do, but we’re going to do it anyway.”

“We aren’t so bold as to claim that the above is the ‘right’ investment philosophy, but it’s ours, and we would be remiss if we weren’t clear in the approach we have taken and will continue to take.”

Interpreted:, “You (shareholder) may not like or understand what we decide to do, and we will not be deterred.”

Amazon’s unparalleled growth has inspired other companies to adopt Bezos’ philosophy of customer obsession. The company’s success is rooted in always being one step ahead of knowing what the customer wants, before the customer even knows they want it, and then providing it.

The term “customer obsession,” was coined by Bezos and has been the reason Amazon continually raises the bar on customer experience exceeding other retailers on price, selection, availability and delivery. Amazon successfully used their technical foundation to build services that now power a majority of Silicon Valley internet startups, and their fulfilment capability outperforms the largest incumbents, which include the United States Postal Service, FedEx, UPS and DHL.

Amazon consistently expands its offerings to customers, while each new offering gives Amazon access to new customer data. Customer data provides Amazon with greater insights into their customers. As a result, Amazon is able to anticipate the needs of their customers and build even more products and services to meet customers’ needs.

In a fascinating CNBC interview, with Bezos, from 1999, he discusses Amazon’s plans for scaling, which of course are based on servicing customers:

Bezos: “I believe that if you can focus obsessively enough on customer experience, selection, ease of use, low prices, more information to make purchase decisions… if you can give customers all that plus great customer service, and with our toys and electronics we have a 30-day return policy…then I think you have a good chance. And that’s what we’re trying to do.”

Bezos’ customer focus goes so far as to link the square footage of Amazon’s distribution space to the needs of the customer.

Bezos: “We have over 3,000 employees and over four million square feet of distribution center space. And those are things I’m very very proud of because with that distribution center space and half a dozen distribution centers around the country, it allows us to get products close to customers so that we can ship to customers in a very timely way, which improves customer service levels. That’s what we’re about. If there’s one thing Amazon.com is about is its obsessive attention to the customer experience, end to end.”

When the interviewer suggests that Amazon is a “pure Internet play” (a company only focused on a specific industry niche), Bezos clarifies that the statement is totally missing the point.

Bezos: “It doesn’t matter to me whether we’re a pure Internet play… we provide the best customer service…They [our investors] should be investing in a company that obsesses over customer experience in the long term. There is never any misalignment between customer interests and shareholder interests.”

At one point, the interviewer compares Amazon, an e-commerce retailer with distribution centers, to Walmart, which has physical retail stores, and suggests that Amazon’s model is cost heavy. Bezos explains that, on the contrary, distribution centers cost less than retail space. However, the interviewer doubles down on his suggestion that Amazon’s model is too bold. The conversation follows…

Interviewer: “OK. So, you’ll open as many square feet of physical space as you have to hire as many employees, as you have…”

Bezos: “to service customers. Absolutely. And we’ll do it as rapidly as we can.”

Interviewer: “That’s a very cost-intense proposition.”

Bezos, patiently, explains the logic and the math.

Bezos: “Not compared to opening an equivalent network of retail stores. Look, when we open a distribution center, we’re opening places where we may pay 30 cents a square foot for a lease instead of paying $7 a square foot for retail space, which you might pay in a high traffic retail area. So when you compare those things, they’re not the same. You can’t compare a big chain of retail stores to half a dozen distribution centers. It’s just not, you know, it’s bad math.”

The interviewer remains dubious.

Interviewer: “Either way, whichever side of the argument, you believe you’re making, it seems to me…”

Bezos: “There’s only one side, which is to obsess over customers.”

The interview continues with the interviewer questioning the razor thin profit margins he suggests Amazon must work with; Bezos explains the rationale behind the company’s scaling.

Bezos: “We’re opening new product categories, and we’re expanding in new geographies. We have whole new business models with things like auctions. Now, we think this is the less risky of the two approaches because scale is important in this business. And you need scale also to offer the lowest prices and the best customer service to people. So scale is important to us, and we’re going to go after that kind of scale.”

The interviewer continues with his argument and accuses Bezos of being arrogant which ultimately shows the interviewer’s short-sightedness.

Interviewer: “Isn’t it to some extent a certain amount of, with all do respect, corporate arrogance, to assume that you can come into these businesses, which you have no experience in, and virtually overnight become the best in those businesses and the market leader in those businesses?”

Bezos: “I don’t think so. So, you know, when we first started selling books four years ago, everybody said, look you’re just computer guys you don’t know anything about selling books. And that was true. But what we really cared about was customers, and now we know a lot about books. When we first started selling music, people said the same thing, but we hired the right people… so, you know, we take the commitment to the customer very seriously, and we’re not about to release something or announce something before it’s ready.”

Overall, the interview underscores Amazon’s complete dedication to the customer, which is common sense to Bezos yet so often overlooked by other companies. Bezos expresses amazement that no one has caught up with their customer approach and states, “we faced no like-minded competition for seven years.”

2.2.2 Startup Examples of Customer Obsession

Fast forward to today and the current e-commerce landscape has changed. There are now millions of other independent, direct to consumer (D2C) brands which are dedicated to the customer and have found a unique voice online, outside of the traditional retail model. Three examples, discussed in further details below, of such brands are Bonobos, the trendy men’s clothing manufacturer; Warby Parker, the online prescription eyewear manufacturer; and Casper, a company that has disrupted the mattress industry.

2.2.2.1 Bonobos

Bonobos was founded by Andy Dunn and Brian Spaly when they noticed how hard it was for men to find a pair of pants that fit. The brand began as an online retailer andwas later bought by Walmart, in 2017, for $310 million.

According to Casey Drake, writer for Endear:

“From day 1, Bonobos vowed to take a different approach to their business model. Instead of investing money in traditional marketing methods, they instead invested in their customer experience and success teams. What resulted was a cult following willing to buy in to whatever new interesting concepts the brand would try.”

Dunn described their approach as “maniacally focused on the customer experience and interacting, transacting and storytelling to consumers.” The company’s popularity grew through word of mouth driven by brand loyalists.

2.2.2.2 Warby Parker

Another brand that focused on customer centricity is Warby Parker, the online retailer of prescription glasses and sunglasses. Warby Parker was founded in 2010 by Neil Blumenthal, Andrew Hunt, David Gilboa and Jeffrey Raider, four students from Wharton. Described as “the most innovative startup of America” by Yashica Vashishtha, writer for YourTechStory, the four entrepreneurs introduced stylish customized eyewear to the online consumer.

Warby Parker’s competitors were Luxottica and LensCrafters. Luxottica sold stylish eyewear, but the prices were high end, and Lenscrafters lacked any sense of style in its branding. Warby Parker’s eyewear options were both appealing and affordable and allowed customers the convenience of trying on up to five pairs in the comfort of their own homes. According to Gilboa, one of the cofounders, “The idea was really based on two simple premises. One is that a pair of glasses should not cost more than an iPhone, and two, that eyeglasses could effectively be sold online.”

The niche product gained immediate traction and further gained popularity after Vogue covered the Warby Parker’s story within the first year of its launch. The brand exuded trendiness, style and a dash of exclusivity, while also being universal. Warby Parker’s branding and customer-focus built a defensive wall that protected them from competitors and other eyeglass manufacturers.

Warby Parker has now gone on to launch physical stores and built its own manufacturing capabilities in an optical lab in Rockland County, New York. In 2018, the company was valued at around $1.75 billion, making it one of the most successful D2C brands in the world.

2.2.2.3 Casper

Casper, an online retailer of mattresses and sleep products, is another brand which used customer experience to disrupt a traditional retail industry. Casper achieved the extraordinary feat of persuading customers to buy a mattress online without first touching/feeling the product. It seems rather counterintuitive that buying a mattress without first trying it would be in the customer’s interests – afterall, who wants a mattress that is too hard, too soft and not just right?

So Casper, through smart marketing, gained the trust of the customer to such an extent that they were willing to entrust Casper with the responsibility of choosing the right mattress for their needs, saving them a whole lot of time and trouble. Using data on actual experiences and customer reviews, $75 gift-card referrals, plus a 100-day guarantee, Casper found the customer’s pain point and fixed it.

Ultimately, Casper built a relationship with the customer and made sure they were educated on their potential purchases, giving them peace of mind—a huge factor for big-ticket items. In January 2020, Casper filed for an IPO (initial public offering) with an initial valuation of $1.1 billion, after its private funding round in March 2019.

2.2.3 Google Cloud: A Failure To Obsess Over the Customer

Amazon’s narrative was originally denounced and met by countless skeptics. Consider the interview with Jeff Bezos at the beginning of this article where the interviewer accused Bezos of exhibiting “corporate arrogance.”

Through its customer mindset, Amazon has obtained long-term permission from the customer and now has long-term permission from Wall Street. Wall Street is no dummy. It looks right to the customer to figure out whether a company is relevant and what it’s future might be. Overall, Wall Street looks at the value chain, and Amazon looks at the customer value chain.

Most entrepreneurs are familiar with the value chain. It is described by Google as “the process or activities by which a company adds value to an article [product], including production, marketing and the provision of after-sales service.”

Fast-forward a few years, and companies like Amazon are now looking at the value chain from the customer perspective. The ‘customer value chain’ is now all of the steps that a customer must take in order to acquire products and services. Therefore, the chain also includes online searching by the customer to learn about a product, product selection, finding a website to buy the product from, clicking, choosing delivery options and so on. For an online retailer, the customer value chain has many more elements to fulfill; therefore, what adds value for the customer, is fewer steps in the acquisition process—enter Amazon’s 1-click ordering.

Google Cloud, on the other hand, is an example of how the customer value chain has not gone quite so well, as Ben Thompson of Strategery explains in an in-depth article.

Selling cloud infrastructure does not seem like much of a stretch for Google considering the vast cloud infrastructure Google uses to power its search engine. The problem, though, is that Google’s value chain is just that, a value chain, not a customer value chain. According to Thompson, “The world of enterprise software is not a self-serve world for the customer (and to the extent it is, Amazon Web Services (AWS) dominates the space). Google, to sell its cloud infrastructure, needs an intermediary layer to interact with relatively centralized buyers with completely different expectations from consumers when it comes to product roadmap visibility, customer support, and pricing.”

Google Cloud remains a distant third to AWS and Microsoft when it comes to cloud technology because Google lacks capabilities in customization, support, and the ability to sell.

Google’s culture has been, according to Thompson, “about making the best product technologically and waiting for customers to line-up. That may have worked for Search and for VMWare, but it’s not going to work for Google Cloud. Instead, the company needs to actually get out there and actually sell, develop the capability and willingness to tailor their offering to customers’ needs, be willing to build features simply because they move the needle with CIOs, and actually offer real support.”

The takeaway here is that for Google Cloud to work, Google should focus not on technology innovation, but rather on its customer.

Activity 1: Evaluate a Startup’s Customer Needs

Activity 1 involves reviewing a startup’s website and evaluating how they market, what it is that they do and, more importantly, who they do it for. The purpose of this assignment is to look at the concepts described in the session within the context of a real-world startup.

The questions are designed to be open-ended;you should place a good amount of thought into your responses as there may be a variety of correct answers and opinions. Teaching notes are included for each question.

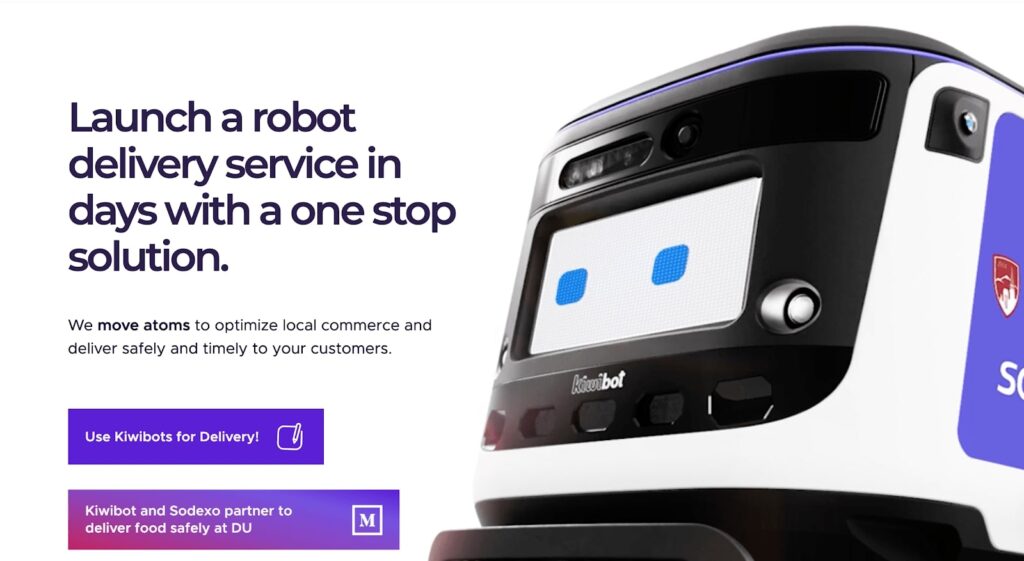

Kiwibot

Kiwibot is a startup which provides hardware and software for last mile robot delivery. They’ve raised $3.5M, according to Crunchbase. Awesome!

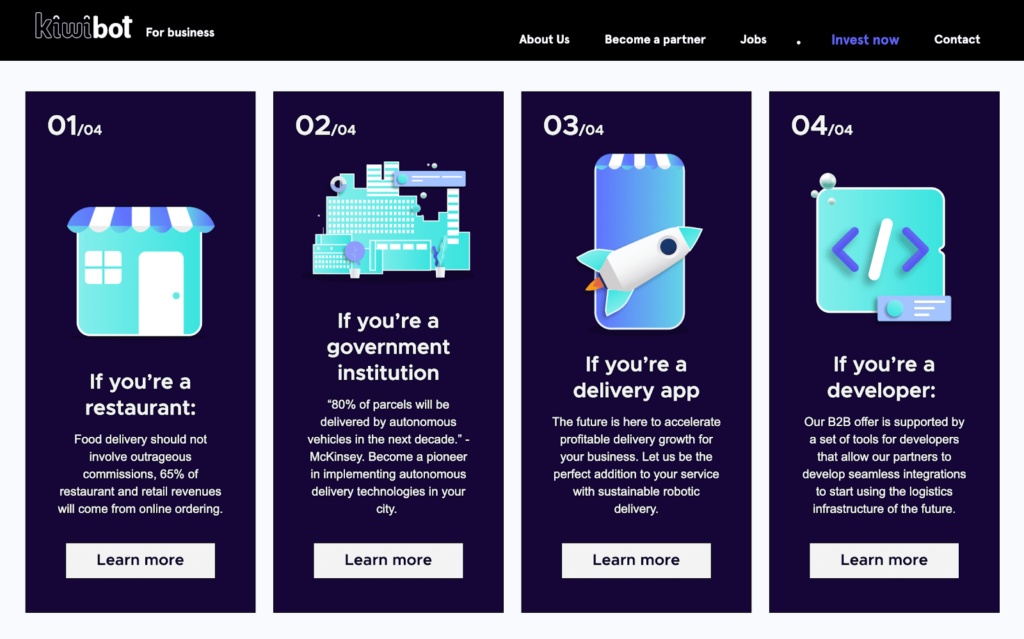

Who is their customer exactly? Try browsing their homepage and see what you will find:

Once you have had a chance to review the customers and value propositions above, please answer the questions below:

When you browse the homepage and see the above information what do you think?

____________________________________________________________________________

____________________________________________________________________________

____________________________________________________________________________

Teacher note: Correct answer is that they lack focus and they are a technology in search of a problem to solve. It is always better to identify your customer before you start marketing, in order to market to your specific customer. No efficient customer acquisition pipeline, digital experience or sales funnel is sufficiently broad and effective to allow for a diversity of customers in the very early stages of a new venture. As an entrepreneur, you must put “all your eggs in one basket” to maximize the impact of your limited resource. That’s why it’s really important to constantly assess your understanding of the customer and adapt your approach to their problem accordingly.

Who is the startup’s target customer?

____________________________________________________________________________

____________________________________________________________________________

____________________________________________________________________________

Teacher note: The answer is that they don’t know who their customer is but they think they could have one of four possible customer segments.

If you were the founder of the startup what might you do to improve your understanding of your customer?

____________________________________________________________________________

____________________________________________________________________________

____________________________________________________________________________

Teacher note: The answer we’re looking for stems from part two of the session and is that they should conduct more research into the possible customer segments to understand who they are best able to solve a concrete problem for.

Which of the four target customer segments outlined do you think is the best?

____________________________________________________________________________

____________________________________________________________________________

____________________________________________________________________________

Teacher note: While students should be able to present a personal opinion here the answer we’re looking for is that it’s hard to say without conducting additional research.

The key takeaway is that if the startup can focus on one of their four customer segments, they can design the perfect solution for that customer. However, designing a solution to serve all four customer segments will leave none of the four customer segments satisfied because the startup’s attention is spread too thin across multiple, unique needs.

Additional Discussion Questions

- As a new company should you have 1 target customer segment, 3 target customer segments, or 5 target customer segments? Why?

- If you are aware of10 potential customers, in one customer segment, yet have identified your one target customer segment is different, should you proceed to sell to those 10 potential customers anyway?

- If a big company, i.e. a potential customer, that is outside of your one, single target customer segment sees another use for your product or technology, should you entertain it?

Note: Most of the time, big companies drain resources. The contracting, legal and compliance processes associated with big companies are often more than a few month’s funding for early stage ventures.

Here are some possible points of view that may emerge in answers to the assignment:

- Kiwibot’s technology serves so many people’s needs! They’re going to be a huge company!

- The problem here is that each of the four customers outlined (restaurant, government, delivery apps, and developers) have unique problems that require unique value propositions.

- Additionally, they’re spread thin when trying to build 4 different solutions at once.

- Each of the four customer types they serve has a different problem.

- Yes, they’ve outlined different problems for each.

- Can their one solution solve for each of these four problems?

- I don’t understand who their customer is…

- Exactly, and it appears that they don’t either which indicates that they could be confused or lacking focus.

3. Preparing to Learn About Your Customer and Company

3.1 Types of Knowledge

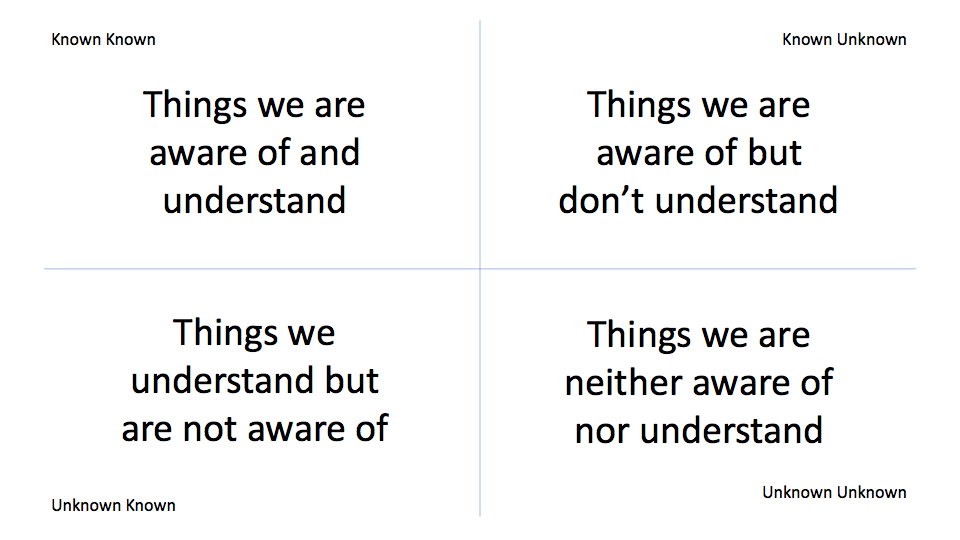

In Entrepreneurial Innovation your level of risk is determined by your knowledge. The more you know, the less risk you face. The less you know, the more risks you face. Therefore, it is important to understand both what you do and do not know.

To expand upon this matrix,

The first thing that must be immediately obvious is that knowledge is relative, unto itself and between people. Therefore, the “we” in this matrix is interchangeable with “I”, “You”, “They”, etc…

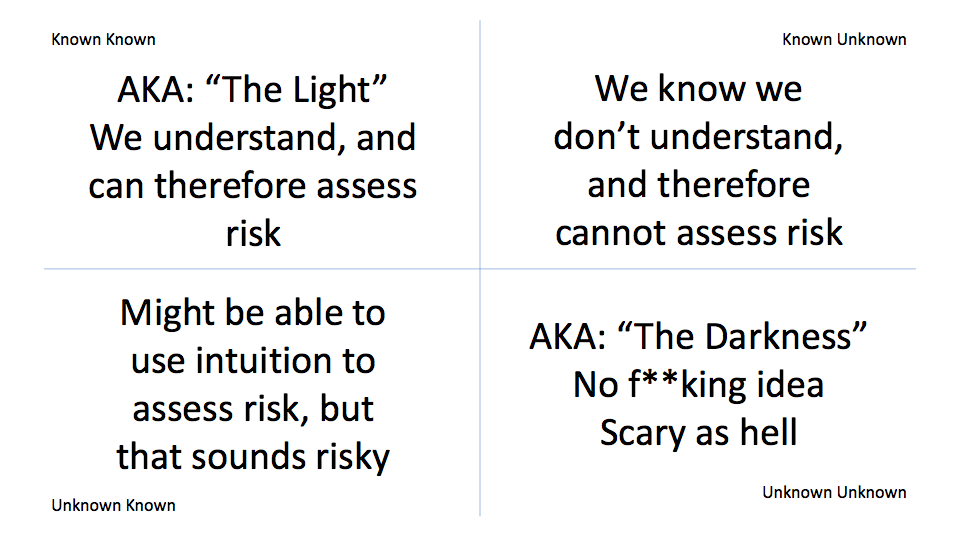

3.1.1 the Interplay of Knowledge and Risk

To be effective in this transition, we must first confront the reality of how we perceive risk.

Opinions are not knowledge. Facts and data that result from quantitative measurement are knowledge. Qualitative insights and executive perspectives are either Known Unknowns or Unknown Knowns but they are never Known Knowns.

Which in turn translates into different levels of perceived and actual risk:

It’s important to contextualize that knowledge is entirely relative. Whereas one demographic “knows” something, another demographic may not yet be aware of the knowledge or may not have accepted the knowledge. This relative distribution of knowledge is particularly important in the context of business as the intent of any good organization is to direct its resources.

On any given team there could be a variety of knowns. To this end, one of the primary purposes of a team should be to optimize the distribution of known knowns by compositing a team who has the requisite knowledge to achieve the goals of a particular task.

To truly know the customer, you must first get into the mindset to learn.

3.2 Customer Mindset

When learning about your customer, leave your biases at the door.

“Real self-confidence is not reflected in a title, an expensive suit, a fancy car or a series of acquisitions. It is reflected in your mindset: your readiness to grow.”

– Carol Dweck, a pioneering researcher at Stanford who specializes in the field of motivation, why people succeed (or don’t) and how to foster success.

You must be willing to look at old problems with a new perspective and understand them anew. You cannot start with preconceptions of what the data will tell you. This is also known as having “beginner’s mind”:

“In the Beginner’s Mind there are many possibilities. In the expert’s mind there are few.”

– Zen Master Shunryu Suzuki, Zen Mind, Beginner’s Mind.

You must have the strength to let your ideas go and the openness to learn:

“The true test of self-confidence is the courage to be open—to welcome change and new ideas regardless of their source.”

– Jack Welch

As you learn about your customer, you must allow the shape of your idea to change shape inline with the customer.

“You must be shapeless, formless, like water. When you pour water in a cup, it becomes the cup. When you pour water in a bottle, it becomes the bottle. When you pour water in a teapot, it becomes the teapot. Water can drip and it can crash. Become like water my friend.”

– Bruce Lee

To achieve this, you must be able to understand and sympathize (ideally: empathize) with the customer:

“there is no way for our innovation to meet unmet unarticulated needs (…) if we don’t listen not just listen to the words but go and go deep to understand what the needs are behind it core innovation”

– Satya Nadela (CEO, Microsoft) speaking with David Rubenstein (co-founder and co-executive chairman of The Carlyle Group)

You must be open to having your initial idea be incorrect. It is much more effective, and will serve you better long-term to invalidate ideas rather than just validate ideas.

“(T)hose who change their minds are the biggest winners because they learned something, whereas those who stubbornly refuse to see the truth are losers.”

– Ray Dalio, American billionaire hedge fund manager and philanthropist and founder of the world’s largest hedge fund

3.3 “brave Space” / Invalidate, Don’t Validate

We must start the learning journey with the open mindset that is needed to conduct customer discovery. It is important that every innovator recognizes that the search for knowledge is the highest priority, even if it makes some people uncomfortable. Participants must be allowed to openly and honestly explore and learn about what is measurably occurring.

What makes innovators great is that they are passionate about an idea and committed. So openness and being incorrect may not be the most natural for innovators, founders, entrepreneurs, managers or anyone. It is important to leave your biases at the door and as you acquire knowledge, be ready to invalidate ideas, rather than to validate every idea. This will help in the long-term and save time, money, emotional anguish and credibility!

There are a range of biases that you should explore in yourself before pursuing a venture:

- confirmation biases;

- self-serving biases;

- optimism/pessimism biases;

- sunk cost bias.

Taking a few practical commitments BEFORE talking to customers can help you “get into the mindset”:

- Commit to the notion that “words are your data”. Record, record, record. That way you can listen again after.

- Make a commitment to solve disagreements based on what customers say. Are you and your co-founders or coworkers arguing about something that can be answered with a customer point of view? For example, your customer thinks feature A should be next, you think feature B. Solving disagreements based on customers input can take some emotion and bias out of the decisions.

- Remember – by focusing on the customer’s problem and not your idea, you will be better off in the long term. You will waste less time and money. This only serves as a help to you.

3.4 Act Like a Journalist

As an innovator, try to embody the characteristics of a journalist, such as:

- They want to learn

- They ask open-ended questions

- They prepare, they come with questions (example questions are further down in this article)

- They re-ask (sometimes in different ways) if questions are not answered or avoided

- They record and take notes.

Similar to the “brave space”, do not try to get the customer to validate your hypothesis. If you go in with the “brave space” mindset, and ask open ended questions, you will be surprised by things your customer says. That is what you want!

In the very early stages of learning about the customer, it is imperative that you personally are gathering customer data. Acquiring customer knowledge should not be outsourced as knowing your customer intimately can be one of your greatest assets. Personally working with customers will allow you to ask questions and clarify feedback, to create intimate customer knowledge,a priority of a great entrepreneur!

3.5 Keep a Customer Mindset

The foundational difference between companies that have a short-term focus and those that have a long-term focus is the company’s mindset. Short-term, investor focused companies have “Business Mindset”. Long-term, customer-focused companies have a “Customer Mindset”. It is this simple, yet foundational difference in mindset, which separates companies that successfully innovate and grow against companies that struggle to remain competitive.

These differences play out across the business:

- CUSTOMER: The business mindset’s customer is the investor, while the customer-mindset’s customer is the end user.

- FOCUS: A business mindset focuses on the P&L, while a customer mindset focuses on the customer.

- GOALS and INCENTIVES: The business mindset strives to hit quarterly numbers and annual commitments. Meanwhile, the customer mindset strives to solve customer problems.

- PLANNING: The business mindset plans in quarterly increments towards annual plans, measured in dollars. Conversely, the customer mindset plans towards near-term customer acquisition, measured in long-term customer satisfaction.

- REPLANNING: Great business plans are reliably drafted no more than a year in advance and include incredible precision. Great customer roadmaps are multi-year and include tremendous uncertainty.

- FLEXIBILITY: The best business plans afford little deviation from the plan. Meanwhile, the best customer plans secure permission to consistently optimize the trajectory of the company and its offerings, as new information is made available.

Table 1 breaks out the differences for easier comparison:

| Business Dimension | Business Mindset | Customer Mindset |

|---|---|---|

| Customer | Investor | End-User |

| Focus | P&L | Customer |

| Goals and Incentives | Quarterly Numbers and Annual Commitments | Customer Problems |

| Planning | Plans in quarterly increments towards annual plans that are designed to create shareholder value | Plans towards near-term customer acquisition measured in long-term customer satisfaction |

| Replanning | Great business plans are reliably drafted no more than a year in advance and include incredible precision. | Great product roadmaps are multi-year and include tremendous uncertainty. |

| Flexibility | The best business plans afford little deviation from the plan. | The best product plans secure permission to consistently optimize the trajectory of the product as new information is made available. |

Most people are more widely familiar with the Business Mindset. It is taught in schools and, if you work in a traditional company, reinforced by the incentives you are given at work.

Innovation in business mindset companies consists of creating short-term gains to appease shareholders, often at the expense of the customer experience and the long-term relevance and viability of the company. This often futile approach is known as “innovation theater”, where a company does things to appease shareholders and not customers.

3.6 Data Saturation

When an entrepreneur begins their primary market research, a critical question is ‘to how many customers should I speak in the first place’? Is it 5 or 50 or 100? What is that magic number? In reality, there is no magic number – however, a great way to gauge the stopping point is when you reach ‘data saturation’.

- Data saturation refers to the point in the research process when no new information is discovered in data analysis, and this redundancy signals to researchers that data collection may cease. Saturation means that a researcher can be reasonably assured that further data collection would yield similar results and serve to confirm emerging themes and conclusions. When researchers can claim that they have collected enough data to achieve their research purpose, they should report how, when and to what degree they achieved data saturation.

One thing to iterate is that once an entrepreneur reaches data saturation → Stop! Customer discovery is an ongoing process which you must commit to throughout your venture life. However, once you hit data saturation, move towards sharing what you learned and executing the ideas.

While there is no “magic number” on when you or a team will reach data saturation, it can be after 6 or 20 interviews, Google “demonstrates that asking five customers will uncover 85% of the problems.” That said, you ultimately have to choose whether you know enough to stop or keep going.

Many entrepreneurs struggle to talk to their customers, especially in their early days. It may take you time to get comfortable having honest conversations with customers and potential customers. However, these conversations are incredibly important because they are the foundation for any business. As referenced in the Research section of this article; a key book recommendation for any entrepreneur is ‘Talking to Humans’, by Giff Constable. It is available as an online PDF here: https://www.talkingtohumans.com/

3.7. Warmup: Review of Existing Literature

To help you find out more about your customer, how to segment them, and how to find out the problem that you can solve, the following section summarizes three important bodies of research: ‘Talking to Humans’, ‘Disciplined Entrepreneurship’ introduces the Beachhead Customer and ‘‘Competing against Luck’ introduces “Jobs to be Done”.

3.7.1 Primary Market Research / ‘Talking to Humans’

In his book, “Talking to Humans”, Giff Constable stresses that there is no replacement for talking to your customers in person. He highlights a typical entrepreneur, who is obsessed about the product and often has many hypotheses – some of which may be right, but others won’t be. He then challenges entrepreneurs to “get ahead of the risk hypothesis that may cause failure” by first laying out the riskiest hypothesis of the business. For those risks having to do with customer, he suggests a three-pronged approach:

- Walk in the customer shoes and buy the product they would buy (ie., your competitor, the replacement, etc);

- Observe customers that are in the process of buying what you are selling;

- Talk directly to the people you want to be your customers.

Prior to conducting primary market research, Constable recommends answering the following questions:

- What do you want to learn?

- From who do you want to learn?

- How will you get to them?

- How can you ensure an effective session?

- How do you make sense of what you learn?

By answering these questions, it ensures your primary market research is much more effective than if you go and ask random people questions. One challenge is determining your “beachhead customer” (further defined in the next session) and finding ways to reach them. However, by being targeted and focused, you ensure finding that persona who is passionate about your idea and has a burning problem to be solved.

Many technology-first innovators tend to prefer to stay in the lab or behind the computer and not talk to customers. Business Innovators generally are happy to talk to customers. However, most approach primary market research as a way to validate their ideas. As an innovator, it is important to get out of the lab (or Powerpoint) and talk to your customers, but it is equally important to not only aim to validate your idea. You want the truth, as that will serve you best in the long term.

To dive deeper into Constable’s theory, view the PDF online here: https://www.talkingtohumans.com/ or book on Amazon: https://www.amazon.com/Talking-Humans-Success-understanding-customers-ebook/dp/B00NSUEUL4

3.7.2 Beachhead Customer / ‘Disciplined Entrepreneurship’

In Disciplined Entrepreneurship, Bill Aulet focuses on the need of selecting a beachhead customer, and defines the beachhead market as:

- The customers within the market all buy similar products;

- The customers within the market have a similar sales cycle and expect products to provide value in similar ways;

- There is “word of mouth” between customers in the market, meaning they can serve as compelling and high-value references for each other in making purchases.

Identifying a beachhead customer enables the entrepreneur to build a product/service for a segment of customers that have a burning problem. Further, the venture will attract efficiencies of scale in the market, both through more scalable product development and marketing.

For example, when you think of Amazon, you may think of electronics, clothing or even groceries, but remember that they were laser focused on physical books in the early stages. Once the company dominated that category for their beachhead customer, they were able to expand outward and offer additional products to more customers.

To learn more about Bill Aulet’s theory of the beachhead customer, buy the book: https://www.amazon.com/Disciplined-Entrepreneurship-Steps-Successful-Startup/dp/1118692284/

3.7.3 Customer Insight – ‘Jobs to Be Done’

In his work on customer insights, Clay Christensen found that innovation is a top priority and simultaneously a key frustration point for global leaders. This is unusual as businesses today know more about their customers than ever before! Christensen, et al. determined that it is not about the quantity of knowledge about your customers but rather, focusing on what the customer hopes to accomplish. He calls this the “job to be done”, a job which you can solve.

One example that Christensen gives is an example of a company constructing high-end condos for people looking to downsize. All of their primary market research asked about features; for example, nicer windows. However, this didn’t budget sales. After zooming out in their discussions with potential customers, the company realized that it was not a feature of the condo that needed to be better but that potential customers had anxiety about moving their lives away from a home they had lived in for decades. This profound understanding enabled the company to adjust their messaging and gain more success. By acquiring customer insight, the company switched their mindset from being a new home construction company to a company in the business of moving lives.

Similarly to the above example, many entrepreneurs may focus too much on a specific product or feature when conducting their primary market research. “Jobs to be done” is a great framework to remind entrepreneurs to zoom out and focus on that problem in people’s lives. Customers will buy products and services to solve a problem; yet successful entrepreneurs must first figure out the problem to subsequently figure out the “job” of your product or service.

To learn more about Clay Christensen’s theory on jobs to be done, buy the book ‘Competing against Luck’: https://www.amazon.com/Competing-Against-Luck-Innovation-Customer/dp/0062435612/

Activity 2: Evaluate Your Customer and Business

Activity 2.1: if You Have Existing Customers, Baseline Existing Knowledge.

- Customer Satisfaction (CSAT)

- Benefits: If your company collects CSAT data then you have a readily available and relatively free source of data.

- Drawbacks: CSAT data will be biased to just those customers who made contact with the CSAT team. You will want a broader cohort to ensure you have a full picture of your customers.

- Exit surveys

- Benefits: Exit surveys can be a rich source of data. What better way to determine what your customers want than by asking what was wrong when a customer stopped using your product?

- Drawbacks: Exit surveys will contain information from passionate users. Some of the perspectives may be overblown, but they should never be dismissed. Try to pinpoint the core reason that the user is leaving.

- Existing customer surveys

- Benefits: If positioned correctly, a survey of existing customers can be an excellent way to discover pain points. Survey responses can be acquired fairly cheaply, often through the draw of free services or a gift card.

- Drawbacks: These are your existing customers—they already relate to your product. Responses may cement choices that are catering to customers in a diminishing segment.

- Focus groups

- Benefits: Focus groups expose and explore general customer pain points.

- Drawbacks: Data from this tool can be too general.

- Market surveys

- Benefits: Market surveys provide control over the data gathered.

- Drawbacks: With that control comes limited overall knowledge.

- Net Promoter Score (NPS)

- Benefits: Industry standard simple question can illuminate areas of strength and weakness in your brand, product or service. Also, NPS is very quick and easy for the customer.

- Drawbacks: More research will be required for deeper insights.

There are a few ways to collect this data, from low-cost do-it-yourself to expensive managed services.

- Low-Cost, Do-It-Yourself

- Expensive Managed Services

- Market Research Firms

- Expert Networks

The data you collect from this process is the foundation for everything that you will do next. To ensure you get the right data, explore as many options as you can. Ideally you will find a tool or firm that has prior experience researching and analyzing your intended customers.

Activity 2.2: Baseline Your Knowledge of the Customer (Knowledge Matrix)

| List the riskiest assumptions for your idea or business: | – – – |

| What (open ended) questions can you ask customers to learn more about one of your risky assumptions? | – – – |

| What assumptions do you have about your customer? Note: Acquired knowledge will come via the next activities | [Picture of customer] |

| What do they need? | |

| By when do they need it? | |

| Demographic Information | |

| Psychographic Information | |

| What keeps them up at night? | |

| What is the favorite thing they own? |

Activity 2.3: Research Tracker

In order to get a real understanding of your customer you must actually talk to them! To get started, you should first identify where you can find your potential customers. Once they are identified, you should approach the individuals and record their names.

Step 1:Finding People to Talk To

Start by making a list of 5 places where potential customers generally gather. Places include a specific aisle of the supermarket, stores they frequent, or Facebook groups in which they congregate.

Where potential customers gather:

- __________________________________

- __________________________________

- __________________________________

- __________________________________

- __________________________________

Step 2: Record names and details

Now that you have identified the places your potential customers gather, visit these places and get permission to quiz customers inside. With permission, approach customers by letting them know the study you are conducting and the goal of your conversation. Once they agree to be surveyed, ensure you write down their name and the notes you gather. Encourage them to document their top objectives for the call. Ask open ended questions.

| # | Name | Phone #/Email/Link | Notes from Conversation | Next Steps |

|---|---|---|---|---|

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 |

Activity 2.4: Pattern Tracker

Now that you have identified your customer and are recording your conversation, it’s important take note of certain patterns in their feedback. The attached worksheet can be used to track patterns and themes that emerge from the conversations with potential customers. In the first column, you can list the potential customers, themes and patterns should be written in the first row and in the end, tally up all of the occurrences for each pattern to identify those that are most prevalent.

Patterns to look out for include attitudes they may have, problems they face or other considerations. Patterns will vary so the most important consideration is to track whichever patterns you see and set them aside for discussion with your team.

Note:it is important to not be deceived by patterns at the qualitative level of research. These patterns should only form the basis of your quantitative research. To truly enhance your pattern recognition, you must also track demographics and psychographics to identify whether patterns or themes are related to those characteristics.

| ↓ Interviewees | Patterns → | Pattern 1 | Pattern 2 | Pattern 3 | Pattern 4 | Pattern 5 | Pattern 6 | Pattern 7 | Pattern 8 | … |

|---|---|---|---|---|---|---|---|---|---|---|

| Name | Description | |||||||||

| Totals |

Example

| ↓ Interviewees | Patterns → | Pattern 1 | Pattern 2 | Pattern 3 | Pattern 4 | Pattern 5 | Pattern 6 | Pattern 7 | Pattern 8 | … |

|---|---|---|---|---|---|---|---|---|---|---|

| Name | Description | Believes… | Cares about… | Problem with y | Problem with z | Values… | Problem with x… | Uses ___ alternative | Uses ___ alternative | |

| Fred Vaughn | Age 44, x, y, z | ✓ | ✓ | |||||||

| Robin Pierce | ✓ | ✓ | ✓ | |||||||

| Kyle Newman | ✓ | ✓ | ✓ | |||||||

| Kristine Tyler | ✓ | ✓ | ✓ | |||||||

| Dave Rodgers | ✓ | ✓ | ✓ | |||||||

| Christian Henry | ✓ | ✓ | ✓ | |||||||

| Alejandro Webb | ✓ | ✓ | ✓ | ✓ | ||||||

| Isaac Ramsey | ✓ | ✓ | ✓ | ✓ | ||||||

| Casey Hawkins | ✓ | |||||||||

| Randall Ball | ✓ | ✓ | ||||||||

| Merrill Cabral | ✓ | ✓ | ✓ | |||||||

| Evelynn Sparkman | ✓ | ✓ | ||||||||

| Tonia Murdock | ✓ | ✓ | ✓ | ✓ | ||||||

| Lucina Rojas | ✓ | ✓ | ✓ | |||||||

| Shakia Roden | ✓ | ✓ | ||||||||

| Totals | 2 | 5 | 4 | 8 | 4 | 7 | 8 | 4 |

These can be identified as patterns that emerge from potential customers and deserve focus.

4. Identifying Your Customer

Now that you know that it is important to focus on one customer segment, you must determine what that customer segment is and who is a part of it. How do you do that?

Talking to (potential) customers, start with a little bit of secondary market research:

- How large is the overall market you’re targeting?

- Who are the primary purchasers in the market you’re targeting?

- What other companies are operating in this market? Who are the biggest players?

- Is every competing company doing the same thing or variations of your plan?

- How much purchasing power is in the market?

Seeking answers to these questions will give you a little bit of background on the market you are entering and will provide you with some knowledge before engaging in a conversation with a potential customer.

Once you have some background information, focus on talking to customers rather than relying on generic online data. Once the conversation starts, explore their interests and thoughts rather than selling them your vision or ideas. At this point, they are not purely customers, rather, they are your guiding posts to your end product.

Many entrepreneurs will think of this as an excellent opportunity to send out a survey, but surveys are quantitative therefore you will only produce measurable results. Instead, you must start with qualitative research to build a foundational set of assumptions that you can test with your quantitative research.

Qualitative Research

Start with qualitative research where you:

- Interview people in a conversation;

- Observe people as they complete tasks;

- Immerse yourself in the life of a potential customer by doing what they do;

- Conduct user tests to watch them use a product.

In qualitative research:

- You can learn a lot about things you didn’t know, even though it is time consuming;

- Open ended questions and answers allow you to effectively learn more about your customer in their own words;

- Customers may ask or answer questions you have not yet thought of;

- You can learn what you would then want to explore or validate in quantitative research.

Through these research tactics you should be looking to uncover answers to questions like:

- What is their daily life like?

- How many children do they have?

- What is their career and why are they on that path?

- What are their day-to-day priorities?

- What problems do those you are interviewing face?

- Which problems are the highest priority for them?

- How do they solve these problems today?

- What is the value of a solution to the problem for them personally?

- Who do they make purchasing decisions with?

This is just a simple selection and you may need to find other answers to truly get to know the customer. There may be additional questions or modifications of the questions above depending on the industry you are working within and who you have interviewed.

Remember: when talking to customers, you cannot make major assessments about a group of customers based on what one person says. Instead you must identify the patterns and themes that emerge from research across subjects. To validate what you have learned in qualitative research, move on to quantitative research.

Quantitative Research

Quantitative research methods, such like surveys, allow you to collect data on a statistically significant number of customers:

- You can get the most possible data with less time investment;

- It’s far easier and requires less logistics/scheduling;

- You don’t have to actually talk to customers

- ^^^ ALSO, common pitfall, which is why you should start by talking to customers.

A deeper understanding of your customer and the problems they face is critical in helping you craft a value proposition for the solution you are presenting. When thinking about your customer segment, you should be looking at an in-depth understanding of the following characteristics about your ideal customer:

- Demographics

- Age

- Gender

- Marital Status

- Income

- Education

- Employment

- Psychographics

- Ideals

- Personality

- Interests

- Opinions

- Values

4.1 Psychographic

To introduce Psychographic – which captures human traits based on psychological attributes, start with this mental exercise:

Think about your favorite brand.

Now, list down everything about yourself* which would explain why you are so drawn to that particular brand.

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

*List down things about yourself: Example, perhaps your attraction to Nike is due to your desire to run a marathon someday. Or perhaps you are an early adapter so you love Apple products.

You likely did not just list down demographic information about yourself. While demographic information may play a role in why you are drawn to a brand, it is likely that the psychographic information about yourself is the bigger driver in why a brand speaks to you.

In short, some entrepreneurs may tick the box by doing demographic surveys, but nothing replaces in-person conversations with customers, where you can best uncover motivations, attitude, aspirations and other psychological information. With this information, you will be able to build the best products and the best messaging for that customer.

One example that shows the importance of both demographic and psychographic information is through the customer persona that Lululemon came up with in their early days:

- Ocean

- 32 year old professional woman

- Makes $100K a year

- Engaged

- Owns her own condo

- Loves to travel

- Loves clothing and is very fashionable

- Never misses a workout; dedicates1.5 hours each day to work out

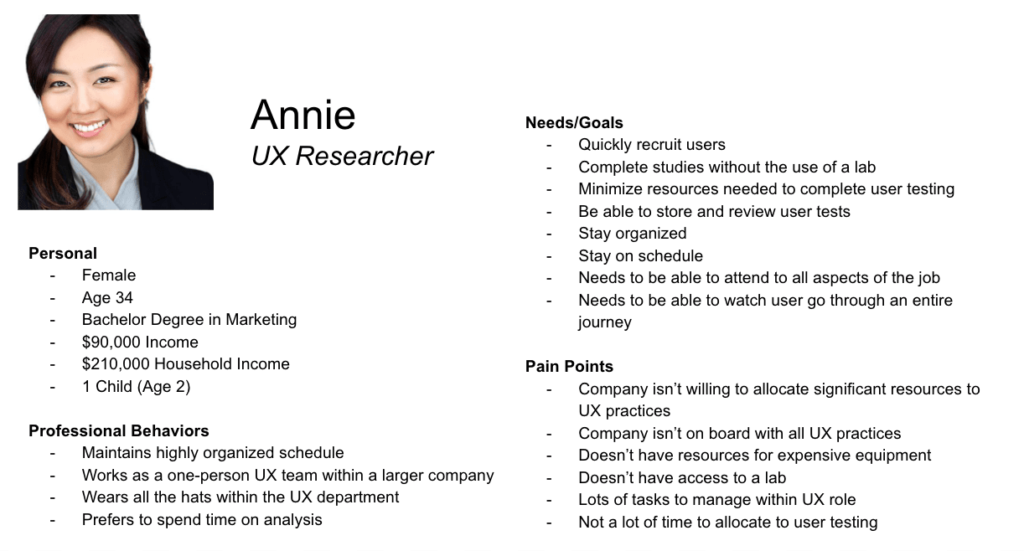

By understanding your customers motivations and priorities, it allows you to better speak to them and reach them, which is essential for all entrepreneurs. Ultimately, you will have enough data to formulate customer profiles called “personas”. A persona is one ideal target customer that represents a series of other customers with the same or similar characteristics as them.

4.2 Aligning Around the Persona

Once you have narrowed in on a group of like-minded target customers, you must figure out how to represent them accurately. The simplest way is to choose the real target customer who most embodies the characteristics of the group of customers you’re seeking to serve. Once the accurate persona is chosen, you should create a customer profile that lists their name, a headshot, and all additional details about them that are common amongst their target customer group. This information is called a persona.

- A persona provides a deep understanding of your customer which significantly derisks innovation investments;

- Empower yourself to understand and consequently empathize with customer;

- Align your team with the customer;

- Provides a customer for you to refer back to when trying to make decisions;

- Allows you and your team to synthesize (and not forget!) all your findings.

Why is it important to write all of this information about the target customer out?

- Some may argue that it’s busy work, saying

- It’s more beneficial to simply go spend time talking to or selling to more customers.

- This is incorrect because it doesn’t align the team around one persona.

- It’s more beneficial to simply go spend time talking to or selling to more customers.

- Some may believe that this helps ensure you have your bases covered.

- This is true, but it’s not the coreanswer. We don’t need to check boxes here – we need to ensure that we truly know who our customer is.

- Others may propose that it’s beneficial to get everyone on the same page.

- This is correct. The entire team should be getting to know the customer. alignment is ultimately what ensures that everyone’s further actions support the customer.

Activity 3: Defining Your Customer

Activity 3.1 Building Customer Personas

- Build personas for 3 types of customers:

- Existing: your current customers

- Existing but do not use your solution: your competitor’s customers

- Not existing – outside our beachhead

- No Skipping – The reason the step must be done:

- A deep understanding of your customer significantly derisks innovation investments by empowering team members to ideally: empathize with customers.

- Who is involved in the step?

- If you’re a solo entrepreneur – just you

- If you’re working with a team, representatives from every department that interfaces with the customer should participate

- What will you need?

- Qualitative interview responses from at least 5 customers from each group.

- Recall: Google “demonstrates that asking five customers will uncover 85% of the problems.”

- Quantitative data from the customers on which you choose to focus.

- Statistically significant deep dives into the customer

- Qualitative interview responses from at least 5 customers from each group.

- Where do you do the step?

- In a “brave space” (https://mitpress.mit.edu/books/safe-spaces-brave-spaces) where the search for knowledge is the highest priority, even if it makes some people uncomfortable. Participants must be allowed to openly and honestly explore and learn about what is measurably occurring.

- When do you know if you’re done?

- When you have achieved data saturation.

- Step Instructions:

- 1) Qualitative Data

- Setup interviews with 15 customers:

- Which customers

- 5 existing

- 5 existing, but using competitor

- 5 not existing

- How?

- 5 existing

- Randomly select 5 customers who you have permission to contact

- 5 existing, but using competitor & 5 not existing

- Post an ad (Craigslist, Facebook, Twitter, LinkedIn, Fiverr) looking for people to participate in a 30 minute qualitative interview. Offer $50 – $100 gift certificates. Tip: Buy the GCs in bulk so you can save $: https://www.raise.com/

- Screen interview candidates by creating a survey and asking them simple questions:

- Show candidates the brand and name of your service and your competitive services

- Traditional

- Emerging

- New Market Entrants

- Ask if they have used your products or services before.

- If Yes = Existing

- If No but has used competitor = Existing, but using competitor

- If No, but has not used any competitor = Not

- Show candidates the brand and name of your service and your competitive services

- Once you have selected 5 from each group, interview candidates

- Ask them to describe themselves

- Have them explain the value proposition you are presenting

- Does this solve a problem for them?

- If yes, how?

- If no, why not?

- Ask them who currently solves their problem.

- Does this solve a problem for them?

- Ask them how they make decisions about this problem?

- Who has credibility?

- Who authentically explores this problem?

- Have them explain

- what yourbrand means to them

- what the competitive brands mean to them

- your value proposition,in their own words

- 5 existing

- Describe your service offering and gauge their reaction.

- Ask them if they have a need for your product or services.

- Which customers

- Setup interviews with 15 customers:

- 1) Qualitative Data

- Collect and slice the following data by generation and demographic:

- What is known?

- How do we measure what is known?

- What story do the measurements tell?

- Have the measurements changed over time?

- If yes: When, how and why?

- If no: Why not?

- Where is it occuring?

- Who is affected?

- Why is it important?

- What is unknown?

- Why is it unknown?

- What metrics do you wish you had?

- Quality Criteria:

- The quality of third party data is assessed by looking at the method of collection, the sample size and the original questions.

- Find multiple authoritative sources, including experts who have already synthesized the data.

- Do not take synthesized interpretations and/or assertions at face value. Think for yourself.

- The quality of third party data is assessed by looking at the method of collection, the sample size and the original questions.

- Narrative Creation

- 1. Who is the customer?

- 2. What does the customer need?

- 3. When does the customer need it?

- Build Personas

- Your customers’ profiles

- With customers, ensure you stress test the narrative and identify areas of sensitivity

- ITERATE

- Then share narratives with entire company

Activity 3.2 Determining Your Beachhead Customer

Once you’ve determined your personas, you must now choose which one will be your beachhead customer. As previously mentioned, Bill Aulet mentions the need for selecting a beachhead customer in his book, ‘Disciplined Entrepreneurship’. He defines the beachhead market as:

- Customers within the market who all buy similar products;

- Customers within the market have a similar sales cycle and expect products to provide value in similar ways;

- There is “word of mouth” between customers in the market, meaning they can serve as compelling and high-value references for each other in making purchases.

Some important nuances to discuss when determining your beachhead customer:

- Does your customer have a different economic buyer than the end user? For instance, an educational startup will have an end user (the child) and an economic buyer (the parent);

- When selling B2B it is important to know what type of company you are targeting and the people to whom you will be selling. While your end user may be in marketing, you may have to sell through finance, technology, operations and many of the management and executive layers. Therefore, these will be part of your beachhead.

Activity 3.3 Integrating Customer

This is a crucial step that is often forgotten! You have done all this hard work talking to your customers and understanding them.

How do you make sure that work helps your new venture move forward to the best of its ability?

Some of this comes from how the customer discovery was conducted. As a reminder:

- Entrepreneurs should not outsource customer discovery but rather, should do it personally;

- Everyone at the company should be involved / have buy in.

It also comes down to how the customer persona is used after:

- Decisions should be made with the customer in mind;

Continue to refer to the person by name. You are selling to this individual, not a nameless customer. Examples:

- Amazon has an empty seat in every meeting for the customer

- Slack would always base product development on customer feedback

It’s important that your entire team knows who they’re serving. Why? Otherwise you may wind up with different team members having different impressions regarding who is the customer. If different team members think the customer is someone slightly different, then they will create value propositions that don’t match the intended customers’ problems and solutions that don’t deliver the right value propositions.

Alignment on the target customer is crucial to ensure everyone is working towards the same goal. A persona is a simple way to help bolster a common understanding in a startup of who is the target customer. Further, by having a visual nature of the person (i.e. headshot), everyone will clearly see who exactly the team is serving.

Every decision that is made and every feature that is built should tie back to the persona. Let’s use Annie for example. When a decision is being made in regards to product development, etc., a question should always be asked “How would that help Annie?”

Caveat: Brand Permission

If a pre-existing company or entrepreneur plans to launch a new product, brand permission is a critical factor. According to the Yale School of Management “brand permission defines the limits of customers’ willingness to accept a familiar brand name in new marketplace situations.”

If Warby Parker, the eyewear retailer, decided to branch out and sell jewelry, it would be a tenuous link, and obtaining brand permission would require massive investment in branding and customer education. Eyeglasses, sunglasses, or contact lenses are what the customer wants from Warby Parker, not bracelets and necklaces.

The point here is that customer centricity guides you in future strategy. The questions to ask are “will your customer want this and, if not, what does that mean for your customer relationship?

Public Data Sources

- Google Trends https://trends.google.com/trends/

- Consumer Barometer – Curated Insights https://www.consumerbarometer.com/en/in-sights/?countryCode=US

- Data Tables & Tools | American Community Survey | U.S. Census Bureau https://www.census.gov/acs/www/data/data-tables-and-tools/

- County Business Patterns (CBP) https://www.census.gov/programs-surveys/cbp.html

- American FactFinder – Download Center https://factfinder.census.gov/faces/nav/jsf/pages/download_center.xhtml

- Free Sources of Market Data and How to use that Data for Business Planning | The U.S. Small Business Administration | https://www.sba.gov/blogs/free-sources-market-data-and-how-use-data-business-planning

- Statistical Abstracts Series http://www.census.gov/library/publications/time-series/statistical_abstracts.html

- National Longitudinal Surveys Home Page https://www.bls.gov/nls/

- World Bank Open Data | Data http://data.worldbank.org/

- fivethirtyeight/data: Data and code behind the articles and graphics at FiveThirtyEight https://github.com/fivethirtyeight/data

- Data.gov http://www.data.gov/

- Download Datasets | Pew Research Center http://www.pewresearch.org/data/

- Dr. John Rasp’s Statistics Website – Data Sets for Classroom Use http://www2.stetson.edu/~jrasp/data.htm

- awesomedata/awesome-public-datasets: A topic-centric list of high-quality open datasets in public domains. https://github.com/caesar0301/awesome-public-datasets

- Cool Datasets https://www.cooldatasets.com/

- Our World in Data https://ourworldindata.org/

- 10 Trust Barometer Insights – edelman.com https://www.edelman.com/10-trust-barometer-insights/

- The American Customer Satisfaction Index National Sector Industry Results http://www.theacsi.org/national-economic-indicator/national-sector-and-industry-results

- Global market and opinion research specialist | Ipsos https://www.ipsos.com/en-ch

- What People Watch, Listen To and Buy | Nielsen http://www.nielsen.com/us/en.html

- Datapure https://www.datapure.co/open-data-sets